Our Personal Insurance Coverage Offerings

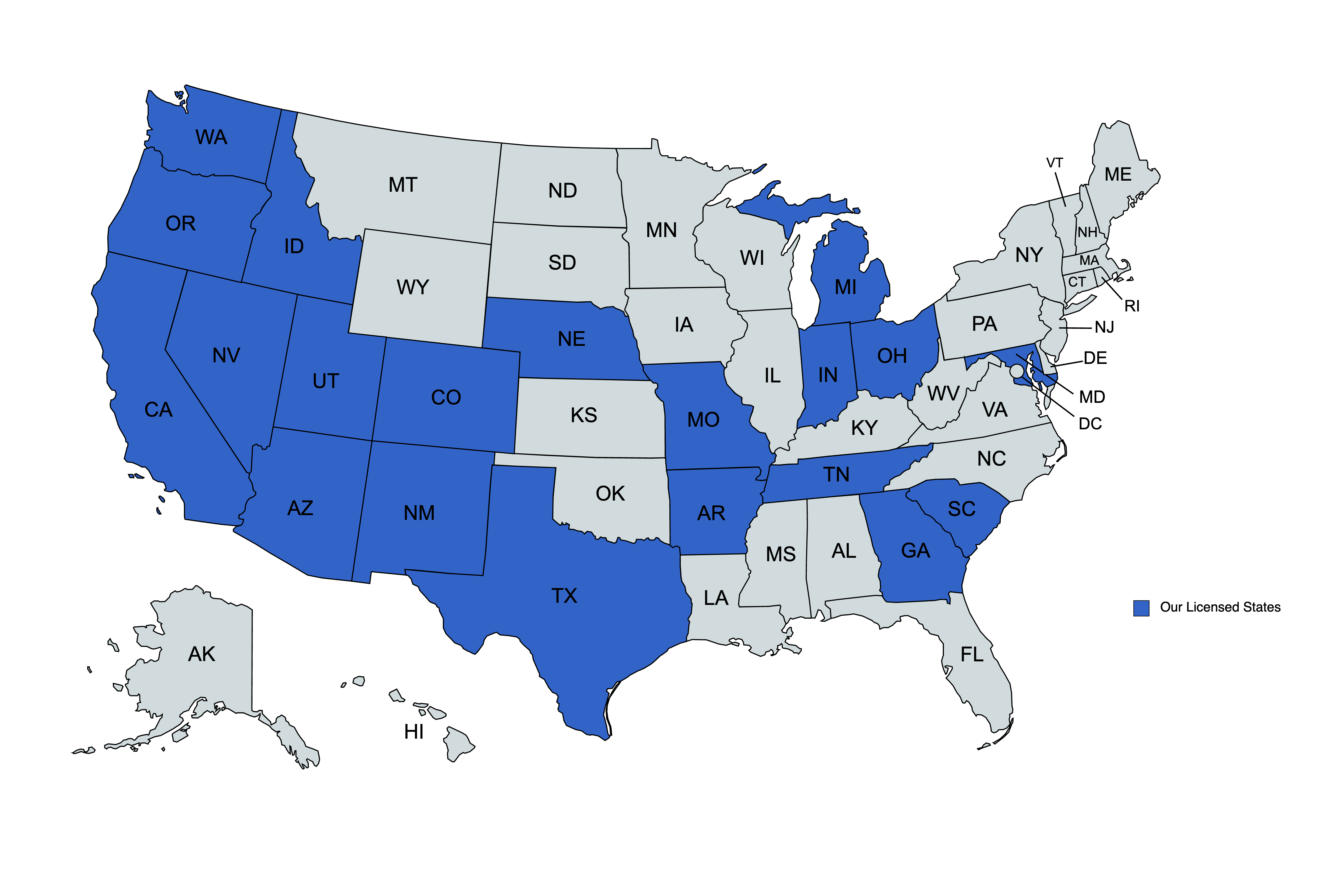

Providing Insurance Solutions Across the Country

“I became a client of the DeLuca Agency when it bought my previous insurance agency. Fortunately, Caula Campbell-Frazier transferred with the company. She has been a delight to work with–always responds quickly, thoroughly and with a real desire to answer questions or assist you. I can’t say enough good things about her. You will not be disappointed.”

“I worked with Caula Campbell to renew my homeowners insurance, she was able to help me by pointing out a gap in my coverage and still was able to lower my premiums. I am enjoying my lower mortgage as a result of the lower escrow. Highly recommend.”

“The agency did a great job on finding better rates for me. The staff is very professional and resourceful. Thanks!”

Spoke with Gloria and she was very knowledge about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.

Spoke with Gloria and she was very knowledgeable about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.Had a great experience with the DeLuca Agency. We quoted with them one year and decided not to move forward because life got busy. But we decided to try again the next year and we were welcomed back without judgment for not having moved forward previously. The agent (Paige Brown) was very professional and extremely knowledgeable about the various companies, coverage, etc. They are able to cater to high end clients and it shows with their knowledge, thoroughness, and expertise. She spent a good amount of time answering our complex questions and informed us about things we never knew before that go deeper into insurance coverage. They have a nice range of products as well and seem to do what’s best for your unique situation.

Paige with The DeLuca Agency was a great help when I needed insurance recently. Highly recommend.

I have worked with the DeLuca Agency since moving to CO in 2019. Danielle Duffy is amazing and has always helped me out with any and everything I have needed. She goes above and beyond every single time I contact her. Beyond that, she is just an overall pleasant person!

We have been insured through The DeLuca Agency for over 2 years and find their customer service highly responsive. The Staff is extremely professional and knowledgeable. I highly recommend this agency for any of your insurance needs.

Our Client Resource Center

Request Certificate

Are you looking for proof of insurance? Contact our dedicated agents to request a certificate.

Advantages of The DeLuca Agency and Denver Insurance Brokerage Inc

1. ACCESS

With our agents’ access to a variety of insurance carriers, we have the ability to offer a wide range of coverage options at competitive prices. Please reach out to one of our agents with any questions you may have.

2. ADVOCACY

We don’t work for a company, we work for you. As your advocate, we are there for you. Our team will work on your behalf to process your claim as quickly and efficiently as possible.

3. KNOWLEDGE

It is our goal to provide our clients with personalized insurance solutions and support during life transitions. Our licensed and experienced agents are ready to assist you with whatever you need.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

13894 Bangerter Pkwy Ste 200 Draper, UT 84020

Phone: 810.639.0078

Email: service@delucaagency.com